Did you know that nearly 80% of drivers could save on their premiums by comparing car insurance quotes? The quest for affordable car insurance quotes is not merely a financial necessity but a strategic imperative, capable of significantly reducing expenses while ensuring adequate coverage. In today’s competitive landscape, securing the best car insurance quotes, tailored to your unique circumstances, is more attainable than ever. By exploring diverse providers and understanding how to obtain these quotes, you can navigate towards lower costs and enhanced coverage. Let’s explore the advantages of finding affordable options and how this simple step can lead to substantial savings in the long run.

Key Takeaways

- Understanding the importance of car insurance quotes.

- Comparing quotes from various providers can lead to savings.

- Affordable car insurance is attainable through informed choices.

- Exploring multiple quotes helps tailor coverage to your needs.

- Regularly reviewing quotes can ensure you get the best rates.

Understanding Car Insurance Quotes

In the realm of auto insurance, grasping the intricacies of car insurance quotes is paramount. These estimates are predicated on personal data and vehicle characteristics, serving as a foundational step in securing adequate coverage. For those inquiring, what is a car insurance quote? It embodies the initial phase in the selection of an insurance policy.

What is a Car Insurance Quote?

An insurance quote represents an estimate from an insurer, detailing the potential premium costs. To procure a quote, one must disclose relevant information, such as driving history, vehicle type, and desired coverage levels. This data is pivotal in determining a personalized quote.

Why Are Quotes Important for Drivers?

The significance of quotes for drivers cannot be overstated. Securing multiple quotes facilitates a comparative analysis of prices and coverage options. This comparative process empowers drivers to identify the most suitable offer, fostering informed decision-making. For a detailed exploration of the quote selection process, refer to this resource, which delves into the nuances of choosing the appropriate insurance plan.

Key Factors Influencing Insurance Quotes

Several key factors influencing insurance quotes are:

- Driving history, encompassing past accidents and infractions

- The make, model, and safety ratings of the vehicle

- Your location, factoring in local crime rates and accident frequencies

- Coverage options chosen, which can differ in terms and cost

These elements are instrumental in shaping the final quote. Mastery over these factors can facilitate negotiations for more favorable rates and customized coverage. Drivers must remain proactive, regularly reviewing their quotes to capitalize on potential savings and superior options.

How to Obtain Car Insurance Quotes

The quest for optimal car insurance quotes may initially appear complex, yet various streamlined approaches are available. Each strategy caters to distinct preferences, ensuring that drivers can select the most suitable method for their needs. Whether you favor digital interfaces, direct personal interactions, or traditional communication, a plethora of options exist to facilitate your exploration of insurance options.

Online Quote Comparison Tools

Many drivers leverage online car insurance quotes via comparison tools, a favored method for its efficiency. These platforms enable users to input their details once, subsequently receiving multiple quotes from various insurers. This approach not only saves time but also offers a comprehensive overview of different pricing and coverage structures. A mere few clicks can facilitate the comparison of car insurance quotes, rendering the selection of appropriate coverage remarkably straightforward.

Working with Insurance Agents

Conversely, a significant number of individuals still opt for the personalized service offered by insurance agents. Agents provide bespoke insights, ensuring that drivers fully comprehend each option. They are adept at navigating intricate policies and recommending coverage tailored to specific circumstances. This personalized approach is particularly valued by some, who prefer seeking professional guidance over digital solutions.

Getting Quotes Over the Phone

The traditional method of getting quotes over the phone remains a viable option. This method enables direct dialogue with representatives, who can elucidate terms and conditions. Engaging with an agent can provide immediate clarity on coverage options, addressing any concerns or questions promptly. This approach fosters a deeper understanding and enhances the sense of security during the decision-making phase.

Factors That Affect Car Insurance Rates

Grasping the intricacies of factors influencing car insurance premiums is paramount for drivers aiming to secure optimal coverage. The calculus of premiums is deeply entwined with individual driving histories, vehicle specifications, and geographical locales. Each of these variables exerts a distinct influence on the financial burden of car insurance.

Driving History and Its Impact

Your driving history profoundly impacts your insurance premiums. Insurers scrutinize your record for accidents, traffic violations, and claims history. A history replete with incidents may signal a higher risk profile, thereby escalating premiums. Conversely, a pristine driving record typically garners lower premiums, indicating a diminished likelihood of claims.

Vehicle Type and Safety Ratings

The type of vehicle you operate significantly influences your insurance premiums. Vehicles boasting high safety ratings tend to attract lower premiums. Conversely, models with a propensity for theft or requiring substantial repairs may incur higher costs. Incorporating features such as anti-theft devices and advanced safety technologies can mitigate these expenses. Thus, a thorough understanding of these factors is crucial for effective budgeting.

Location and Its Role in Pricing

Your geographical location profoundly impacts your car insurance premiums. Urban environments typically command higher premiums due to elevated accident and theft rates. State-specific regulations also play a pivotal role in determining costs. Furthermore, weather-related risks and the frequency of natural disasters factor into insurers’ assessments of location-based pricing.

Types of Car Insurance Coverage Available

Grasping the nuances of car insurance coverage is paramount for making enlightened decisions. Each coverage category offers distinct protections, ensuring comprehensive coverage for you and your vehicle in diverse scenarios.

Liability Coverage Explained

Liability coverage, a fundamental aspect of car insurance, is obligatory in the majority of jurisdictions. It serves to compensate for damages and injuries to third parties when the policyholder is deemed responsible for an accident. This coverage encompasses bodily injury liability, which covers medical costs for injuries to other drivers and passengers, and property damage liability, addressing expenses related to damage to others’ vehicles or property. It is imperative to maintain adequate liability coverage limits to avert substantial financial burdens in the event of an accident.

Comprehensive vs. Collision Coverage

Understanding the distinctions between comprehensive and collision coverage is crucial when selecting car insurance. Comprehensive coverage safeguards your vehicle against non-collision-related perils, such as theft, vandalism, or natural disasters. Conversely, collision coverage is designed to compensate for damages resulting from collisions with other vehicles or objects, irrespective of fault. The choice between these options significantly influences your insurance premiums and overall peace of mind, particularly considering your vehicle’s age and value.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage offers critical protection against accidents involving drivers with insufficient insurance. This coverage ensures that your medical expenses and other damages are covered, even if the at-fault driver is unable to compensate. Possessing this coverage fortifies your financial security against the perils posed by uninsured or underinsured drivers.

Saving Money on Car Insurance Quotes

Exploring avenues to diminish your car insurance expenditures can profoundly affect your fiscal well-being. A plethora of methods exist to procure cost-effective car insurance quotes, enabling you to attain affordable premiums without compromising on coverage. By adopting the most efficacious strategies, you can garner substantial savings.

Discounts You Might Qualify For

Insurance entities frequently proffer sundry discounts, capable of reducing your premiums. Notable among these are:

- Multi-policy discount: Obtain savings by bundling policies, such as home and auto.

- Good driver discount: Benefit from maintaining an unblemished driving record.

- Student discount: Insurers often reward students with commendable academic achievements.

Investigating these avenues can reveal discounts you are eligible for, significantly impacting your premium costs.

Increasing Your Deductible

Modifying your deductible can substantially alter your premiums. By selecting a higher deductible, you commit to bearing greater financial responsibility in the event of a claim. Conversely, many insurers offer premium reductions in exchange. Assess the potential savings against your capacity to absorb increased costs in the event of an accident. This adjustment represents a prudent approach to reducing your car insurance costs.

Bundling Insurance Policies

One of the most effective strategies for cumulative savings on insurance expenditures is bundling policies. Insurers often extend attractive discounts to customers who consolidate multiple policies, such as auto, home, and renters insurance. This approach not only streamlines management but also increases the likelihood of qualifying for additional discounts, leading to enhanced savings.

Common Car Insurance Myths Busted

The intricacies of car insurance often give rise to misconceptions, potentially leading to financial burdens for drivers. This segment aims to dispel prevalent myths, thereby illuminating the essence of policy selection.

Myth: All Insurance Companies Are the Same

The notion that all insurance entities are indistinguishable is a pervasive fallacy. In reality, each provider offers distinct rates, coverage options, and service quality. It is imperative to delve into these disparities to identify the most suitable policy for one’s requirements.

Myth: You Shouldn’t Compare Quotes

Another entrenched myth posits that quote comparisons are futile. Conversely, such endeavors can unveil substantial savings opportunities. Many individuals fail to appreciate the magnitude of premium variations across different insurers. Engaging in comparative analysis can lead to considerable financial advantages, ensuring that one does not overexpend on coverage.

Myth: Your Credit Score Doesn’t Matter

Some drivers harbor the misconception that their credit score is irrelevant to insurance premiums. This is a damaging belief. Insurers frequently leverage credit history to assess risk, thereby influencing premium rates. Recognizing this relationship empowers drivers to enhance their credit standing, thereby securing more favorable insurance rates and dispelling the myths that pervade the industry.

The Importance of Reviewing Your Policy

Engaging in the periodic review of your policy is paramount for guaranteeing that your coverage remains congruent with your evolving needs. Life’s vicissitudes, such as a relocation, matrimony, or acquisition of a new vehicle, necessitate policy adjustments. The recognition of when to reevaluate coverage is imperative for both enhanced protection and fiscal prudence.

When to Reevaluate Your Coverage

There exist particular junctures that herald the necessity for a reassessment of your car insurance:

- Following significant life events such as marriage or divorce

- Upon transitioning to a new geographical locale

- Upon acquiring a new automobile

- Post-receipt of a traffic citation or accident

Each of these scenarios may influence your coverage requirements and premiums, underscoring the importance of timely evaluation.

Factors to Consider During Review

During the policy review process, it is crucial to consider several pivotal elements:

- Your current coverage limits

- Deductibles and premiums

- Discounts that may apply based on your circumstances

Grasping these factors facilitates the making of informed decisions while reviewing your policy.

Shopping for New Quotes Annually

Another indispensable practice is shopping for new quotes annually. This habit not only keeps you abreast of market trends but also enables the discovery of potential savings. By comparing multiple offers, you can secure a more advantageous deal, ensuring optimal value for your coverage.

Tips for First-Time Car Insurance Buyers

For those embarking on their first journey into the realm of car insurance, the landscape can appear daunting. Grasping the fundamental coverage requirements is paramount, ensuring the selection of a policy that aligns with personal and financial circumstances. Moreover, the ability to seek out quotes with acumen can yield substantial savings, while avoiding common pitfalls is of utmost importance.

Understanding Basic Coverage Needs

Initiating the process with a clear comprehension of coverage essentials is imperative. Familiarity with liability, collision, and comprehensive coverage can refine your policy to meet your unique requirements. First-time buyers often neglect critical aspects, resulting in insufficient protection. It is advisable to scrutinize:

- State-mandated minimums

- Your driving practices

- The valuation of your vehicle

How to Shop Smart for Quotes

Efficiently navigating the quest for quotes necessitates the utilization of diverse resources. Online comparison tools are particularly beneficial for swiftly evaluating multiple options. Additional strategies include:

- Obtaining quotes from multiple insurers.

- Thoroughly examining each policy’s coverage details.

- Considering feedback from customers and insurer ratings.

This methodology not only secures competitive rates but also facilitates the identification of coverage that is precisely suited to individual needs.

Common Mistakes to Avoid

Many novices in the car insurance market succumb to several prevalent errors. Recognizing these pitfalls can avert long-term financial repercussions. Common mistakes include:

- Exclusively prioritizing cost over comprehensive coverage.

- Ignoring the necessity of regular comparison of quotes.

- Overlooking available discounts.

By circumventing these pitfalls, newcomers can make well-informed decisions, securing the appropriate insurance without incurring unnecessary expenses.

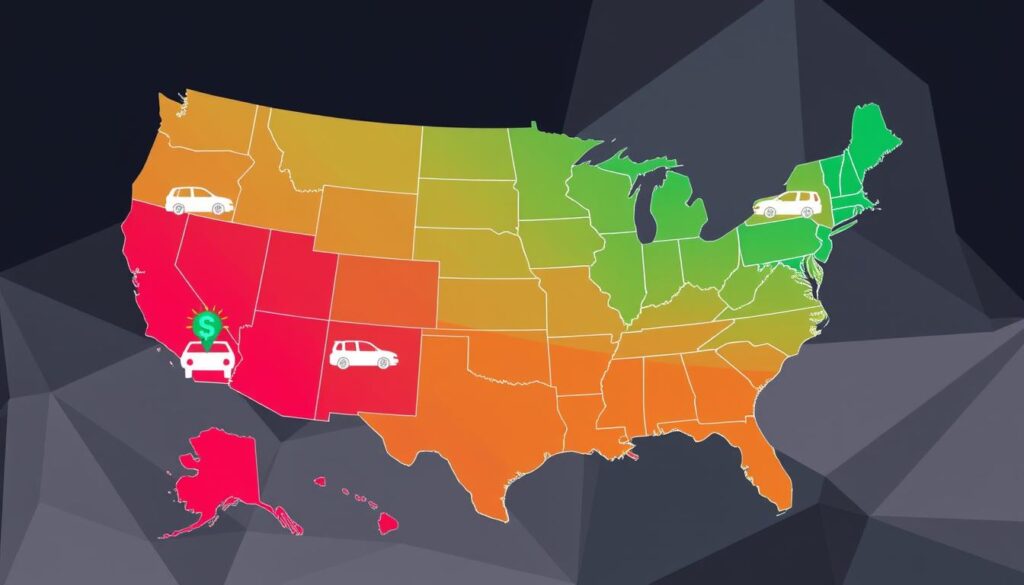

Regional Differences in Car Insurance Rates

The variability in car insurance costs across different regions is noteworthy. An understanding of the local factors influencing these rates is crucial for drivers. State regulations, population density, and local risks are pivotal in determining premiums.

How Different States Calculate Rates

States employ distinct methodologies to calculate car insurance rates. They consider driving records, accident statistics, and theft prevalence. These criteria result in premiums that reflect the local market and associated risks.

Major Cities and Their Average Insurance Costs

Urban areas exhibit significant disparities in average insurance costs. Cities with higher populations often witness increased competition among insurers, leading to more affordable premiums. Recognizing these regional differences aids drivers in identifying cost-saving opportunities.

Regional Discounts or Special Offers

Insurers frequently offer regional discounts and special offers. These can substantially reduce monthly payments. It is imperative for residents to explore these discounts to optimize their savings when choosing a policy.

Using Technology to Your Advantage

Technology has emerged as a pivotal tool in the pursuit of advantageous car insurance rates. It enables consumers to navigate the complexities of finding optimal quotes and managing their policies with unparalleled efficiency. The advent of apps for easy quote comparison has revolutionized this process, rendering it more accessible than ever to secure competitive premiums.

Apps for Easy Quote Comparison

Various digital platforms and mobile applications offer a streamlined, user-centric approach to comparing quotes. By inputting their details once, users can instantly receive estimates from multiple insurers. Notable examples include:

- Policygenius

- Insurify

- Gabi

These tools not only expedite the process but also empower users to make informed decisions. They present a spectrum of options that align with their coverage requirements and financial constraints.

How to Use AI for Better Rates

Artificial intelligence is increasingly pivotal in the realm of car insurance technology. Insurers leverage AI to scrutinize extensive datasets, enhancing risk assessment and personalizing insurance offerings. This innovation enables drivers to receive quotes that are meticulously tailored to their specific circumstances, potentially leading to more favorable rates than traditional methods can offer.

The Future of Car Insurance Technology

Future innovations, such as telematics and usage-based insurance models, are poised to redefine the industry further. These technologies allow insurers to monitor driving habits and adjust premiums accordingly, promoting safety and encouraging responsible driving. As car insurance technology continues to advance, consumers can anticipate a plethora of new tools and resources aimed at improving their insurance experience and financial outcomes.

Handling Insurance Claims Effectively

Grasping the intricacies of insurance claims can profoundly alter the aftermath of an accident. Mastery over the steps to take after an accident is paramount, ensuring safety, meticulous documentation, and timely submission. This acumen is particularly critical when considering the impact of quotes on claims processing and the likelihood of claim denials.

The Steps to Take After an Accident

Immediate action post-accident is imperative for effective claims processing. The following are critical steps to take after an accident:

- Verify safety by assessing injuries and relocating to a secure area.

- Summon emergency services if the situation warrants it.

- Document the scene by photographing vehicle damage and other pertinent details.

- Exchange vital information with other drivers, including names, contact numbers, and insurance particulars.

- Inform your insurance provider expeditiously to initiate the claims process.

How Quotes Affect Claims Processing

Estimates from various insurance entities can profoundly sway the efficiency of claims resolution. Comprehending the impact of quotes on claims processing empowers policyholders to make strategic decisions. Accurate quotes facilitate adjusters in accurately assessing damages, thereby accelerating the claim settlement process.

What to Know About Claim Denials

Knowledge of common claim denial causes can prepare you for potential hurdles. Familiarize yourself with reasons such as:

- Insufficient documentation or evidence.

- Delays in filing claims.

- Policy exclusions not clearly understood.

In the event of a claim denial, it is essential to understand your rights and available options. Seek professional assistance when necessary, contacting experts in handling insurance claims.

The Role of Customer Service in Insurance

In the insurance sector, customer service is paramount, shaping the client’s interaction with their providers. The necessity of prompt and effective support is undeniable. During critical periods, such as claims processing, clients anticipate immediate and satisfactory communication from their insurers.

Importance of Responsive Support

Support that is both timely and beneficial cultivates trust. Clients reaching out to their insurers seek guidance, clarity, and solutions. Insurers renowned for their superior customer service often cultivate enduring client relationships. Such loyalty can manifest in favorable customer reviews on insurers, underscoring their dependability and worth.

Evaluating Customer Reviews on Insurers

Before opting for an insurance company, scrutinizing feedback from current and former clients is crucial. Customer reviews on insurers reveal service quality’s highs and lows. Key aspects to focus on in these reviews include:

- Timeliness in responses

- Professionalism and friendliness

- Effectiveness in resolving issues

- Overall satisfaction ratings

Grasping the impacts of customer service aids potential clients in making informed decisions. Insights from reviews profoundly influence one’s choice-making process.

How Customer Service Impacts Policy Decisions

The caliber of customer service profoundly influences policy choices for many. Clients may opt to renew their policies or explore alternatives based heavily on their interactions with service staff. Outstanding customer service can result in:

- Enhanced customer retention

- Increased referrals

- Improved brand reputation

For further insights on enhancing customer interactions within insurance, delve into the future of customer service in insurance. A well-structured support system ensures customers feel appreciated and comprehended, fostering a more favorable overall experience.

Annual vs. Monthly Premiums: What’s Best?

In the realm of car insurance, discerning between annual and monthly premiums is crucial for financial planning. This distinction significantly influences your budget and insurance needs. We delve into the benefits of annual payments, the drawbacks of monthly installments, and the impact of payment frequency on insurance quotes.

Advantages of Paying Annually

Annual payments often result in lower overall costs, thanks to discounts offered by insurance providers for upfront payments. This approach can significantly reduce your expenses compared to monthly installments. Additional benefits include:

- Lower administrative fees, a common drawback of monthly payments.

- Reduced risk of missed payments, thereby avoiding late fees and coverage disruptions.

- Enhanced peace of mind, knowing your insurance is secured for the entire year.

Pros and Cons of Monthly Payments

Monthly payments offer flexibility, ideal for those without immediate access to a large sum. This method facilitates easier budgeting, as premiums are spread out over the year. However, there are notable drawbacks:

- Higher total premium costs due to service fees.

- Increased risk of coverage lapses or cancellations for missed payments.

- Less likelihood of securing discounts typically reserved for annual payers.

How Payment Frequency Affects Quotes

Payment frequency significantly influences insurance quotes. Insurers often adjust rates based on payment frequency. Annual payments are generally viewed as lower risk, potentially leading to more favorable quotes. Conversely, monthly payments may incur slightly higher rates due to administrative costs and the risk of non-payment. Grasping these dynamics is essential for making an informed decision on your payment method.

Next Steps After Receiving Quotes

Upon acquiring multiple car insurance quotes, the subsequent phase necessitates a meticulous comparison of coverage options. This entails scrutinizing not only the premium costs but also the specific coverages, deductibles, and limits each policy encompasses. A thorough comprehension of the inclusions within each quote is imperative, ensuring the selection of optimal protection without incurring unnecessary expenses.

Comparing Coverage Options

During the comparison process, it is essential to identify the features that hold paramount importance, such as rental car reimbursement, roadside assistance, or accident forgiveness. It is crucial to delve into the fine print to uncover any exclusions or limitations that may pertain. This exhaustive evaluation facilitates the identification of the most appropriate coverage, thereby preventing the omission of critical protections.

Choosing the Right Insurer for You

The selection of an insurer transcends mere cost considerations; it encompasses factors such as customer service quality, company reputation, and financial solidity. Insights garnered from existing customers’ reviews and ratings can illuminate the insurer’s claim handling efficacy and overall customer satisfaction. This information is instrumental in making an informed decision, thereby ensuring peace of mind as one proceeds with policy selection.

Finalizing and Understanding Your Policy Terms

Upon selecting an insurer, it is imperative to finalize the details and comprehensively grasp your policy terms. A thorough review of the document is necessary, focusing on coverage specifics, endorsements, and payment structures. Addressing any ambiguities prior to signing is crucial to avoid potential misunderstandings. For further guidance in navigating rental insurance options, refer to this resourceful link.